san francisco sales tax rate history

Sales tax total amount of sale x sales tax rate in this case 85. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles.

States With Highest And Lowest Sales Tax Rates

The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division.

. Geographic areas can be defined by supervisorial district or at the census track level. The San Francisco sales tax rate is 0. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

The South San Francisco Sales Tax is collected. The total sales tax rate in any given location can be broken down into state county city and special district rates. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Did South Dakota v. The current total local sales tax rate in San Francisco CA is 8625. The California sales tax rate is currently.

Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income. Click on the picture below or here to access the web tool. Citys General Fund Local Portion is 1 of the total rate throughout the period shown.

Proposition N passed in November 2008 created a new tax rate of 15 for transactions greater than or equal to 5 million. The average sales tax rate in California is 8551. Sales Tax Breakdown San Francisco Details San Francisco CA is in San Francisco County.

The minimum combined 2022 sales tax rate for San Francisco California is 863. 750 Is this data incorrect The South San Francisco California sales tax is 750 the same as the California state sales tax. Get rates tables What is the sales tax rate in San Francisco California.

The December 2020 total local sales tax rate was 8500. Historical Tax Rates in California Cities Counties. The minimum combined 2022 sales tax rate for San Francisco California is.

Neighboring cities tax rate bay area counties lowest city tax rate highest city tax rate average county tax rate select us cities tax rate el cerrito 975 alameda 925 975 933 chicago 1025 hayward 975 contra costa 825 975 849 new orleans 1000 san leandro 975 marin 825 900 839 seattle 1010 alameda 925 napa 775 825. San Francisco is in the following zip codes. These transactions had previously been taxed at the 075 rate.

Look up the current sales and use tax rate by address Data Last Updated. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar years 2017 to 2021 in user-defined areas of the City. 5 digit Zip Code is required.

340 for each 500 or portion thereof. Sales Tax in San Francisco CA. Sales Tax Collections How Performance is Measured.

This is the total of state county and city sales tax rates. 9500 7875 Tulare Kern San Diego Amador Merced Calaveras Contra Costa Sacramento Los Angeles Los Angeles Alameda San Diego Kern Stanislaus Santa Cruz Los Angeles Tulare Mariposa Trinity Siskiyou Placer Kern Lassen Humboldt Los Angeles Los Angeles Los Angeles Los Angeles Calaveras Yolo Los Angeles. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

Rates are for total sales tax levied in the City County of San Francisco. There is no applicable city tax. 94101 94102 94103.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The San Francisco sales tax rate is. You can find more tax rates and allowances for San Francisco County and California in.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. FY 2010-11 CY 2010 9 Access Line Tax per line Access Line Tax. Fees currently range from 25 to 500 depending on firms payroll expense tax value.

3 Sales Tax. The December 2020 total local sales tax rate was 8500. 7375 7750 8250 7250 7750 7750 9000 Plumas Los Angeles Los Angeles Shasta Los Angeles San Mateo Marin Santa Cruz Solano Mono Alameda Riverside Butte Contra Costa Santa Barbara Los Angeles Lassen Trinity Santa Cruz San Bernardino San Bernardino Shasta Fresno Tuolumne Inyo San Bernardino Monterey Butte El Dorado Fresno Los Angeles.

The current total local sales tax rate in San Francisco CA is 8625. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. A county-wide sales tax rate of 025.

Fees currently range from 25 to 500 depending on firms payroll expense tax value. A combined city and county sales tax rate of 25 on top of Californias 6 base makes San Francisco one of the more expensive cities to shop in. The Bradley-Burns Uniform Local Sales.

3 - November 1 1949 to March 31 19684 - April 1 1968 to April 30 19825 - May 1 1982 to January 31 19886 - February 1 1988 to Present Farm Equipment 2 - 1963 to 19683 - 1968 to 200125 - 2001 to June 30 20050 - July 1 2005 to Present County11 Alachua Rate 12070 235 Tax History. The County sales tax rate is. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

More than 250000 but less than 1000000.

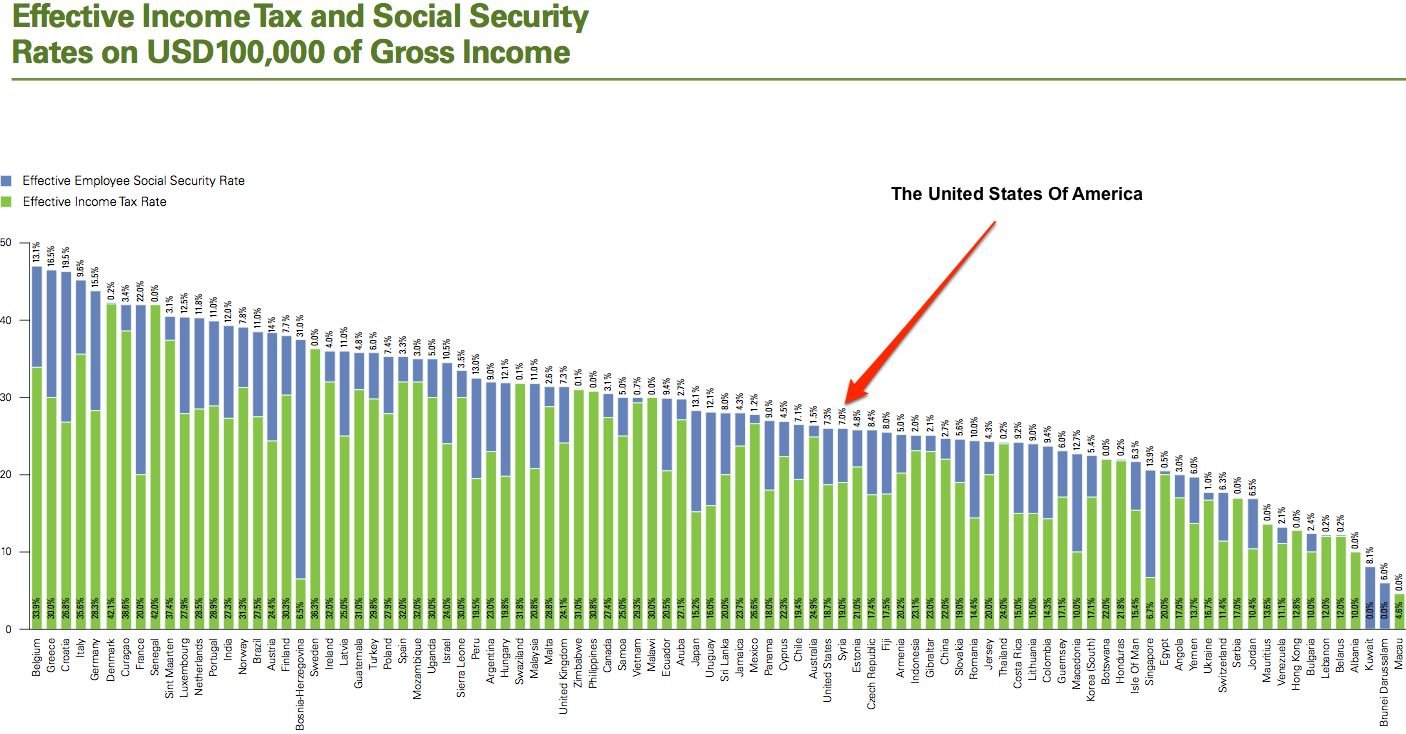

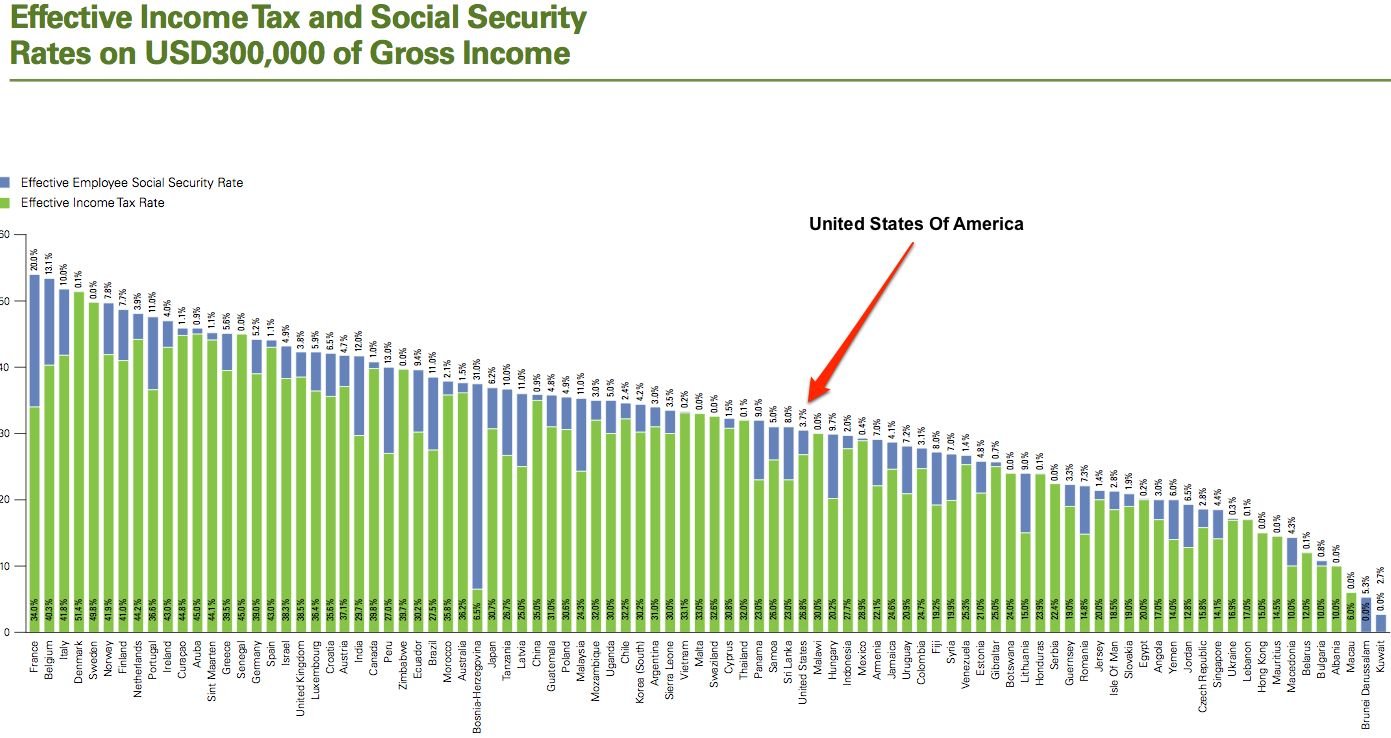

How Low Are U S Taxes Compared To Other Countries The Atlantic

Understanding California S Property Taxes

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Understanding California S Property Taxes

Frequently Asked Questions City Of Redwood City

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Property Taxes

Understanding California S Property Taxes

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Collections City Performance Scorecards

Secured Property Taxes Treasurer Tax Collector

2022 Federal State Payroll Tax Rates For Employers

California Sales Tax Rates By City County 2022

California City County Sales Use Tax Rates

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Do State And Local Sales Taxes Work Tax Policy Center

Property Tax History Of Values Rates And Inflation Interactive Data Graphic Washington Department Of Revenue